Non-market affordable housing

Typically when people in America mention affordable housing they mean non-market housing:

Unintended consequences include discourage saving, discourage working, discourage sharing cost such as roommate and housemate, segregation, polarization, etc.

Depending on government subsidy can only cover a small portion of the need. In Houston, there are only 19 affordable and available units per 100 extremely low-income households.

We recommend focusing subsidy to help lower income people to buy land, smaller amount per household with larger impact than subsidizing home buying.

We recommend focusing subsidy to help starter home development, mixed income and use, like specifying:

NOAH, naturally occurring affordable housing

Smaller housing units tend to be multi-family. That is why some older, smaller sized apartments in low cost area are called "naturally occurring affordable housing", NOAH.

However, they tend to be replaced by higher priced housing for profit.

Nationally, low-cost rentals have disappeared at a rate of more than half a million units per year, according to this

report .

Market and homeownership

In typical American thinking, market-rate housing is not supposed to be affordable while affordable housing needs government subsidy. The root cause is economic polarization. Economic polarization is a natural tendency of the free market. Poor people cannot afford to buy a home and cannot maintain high enough credit score to qualify for a loan as even government subsidies still require credit score. They have no choice but to rent. With lower credit score poor people can only find higher rent with higher deposit for similar size housing. Many are surviving between renting and homelessness, a hole difficult to climb out.

Poverty, especially when not homeowners, leads to higher crime and lower rating schools, at least that is typically what people see in the US. For people with higher income, they naturally look for locations that have lower crime and better schools. To keep poor people away, the only legal way in the US is to prevent lower cost housing in the neighborhood. For developers and builders, it is lower risk and higher profit to build higher priced larger homes for the people who can afford it. The result is segregation of population above median income who can afford to own homes and population with lower income who cannot afford to own homes.

For a landlord business, like any capitalist business, profit is the only motivation. They need to maintain positive cashflow and maximize profit. Renters pay landlords' mortgages, otherwise landlords cannot maintain positive cashflow and sell. But landlords also get to keep the equity in the homes. The renting model in the US is a transfer of wealth from the poor to the owners. When governments subsidize rent, they are also subsidizing landlords and extend the wealth transfer to landlords.

Median family net worth is $396k for homeowners but only $10k for renters, according to this Federal Reserve pubication .

A related problem for home affordability is need for driving. The need for driving is part of the need for segregation between rich and poor. It is illegal to dscriminate against the poor but governments are happy to help creating distance by building more and more roads for cars, more need for driving. This is why public transportation in the US is not economical. Driving is significant portion in household expenditure, 2nd to housing. Need for more driving adds burden to people and cities, and environment.

Half the American population prefer walkable neighborhoods but the segregation driven market is not providing them walkable neighborhoods.

For a market to support affordable housing, the first priority is to convert renters to owners. 90% homeownership rate is the target, as 10% people in US would not want to own a home.

When 90% residents are homeowners, crime rate will drop. With more people walking, crime rate will also drop.

This is the first requirement for walkable neighborhoods. When mixed income population can live in walkable neighborhoods where crime rate will be lower, driving cost is also lower.

If a lower cost neighborhood, likely higher crime lower school rating, is converted to 90% homeownership rate walkable neighborhood, land price will rise as crime rate drops and school rating rises, as well as more amenities built. If some homeowners feel property tax is becoming too high, they can sell and make capital gain on their homes, then buy home in a lower priced neighborhood.

We just need to continue building walkable neighborhoods with enough smaller cheaper homes for people to buy.

Market-rate affordable housing

Market rate affordable housing is possible with suitable government policis and social enterprises that combine profit motivation with social missions like increasing homeownership rate.

What price homes Americans can afford

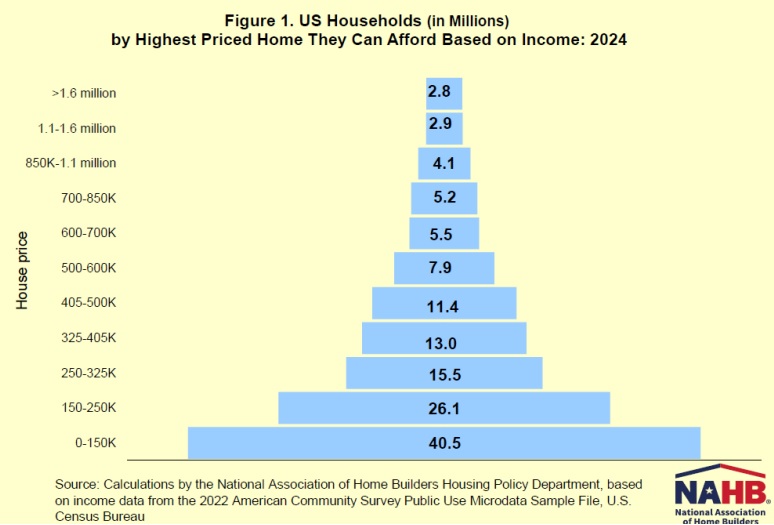

40.5 million US households can only afford homes priced below $150k, 31% of the households. 66.6 million US households can only afford homes priced below $250k, 51% of the households. Median Sales Price of Houses Sold was 442,600 for 2022.

What starter homes to build

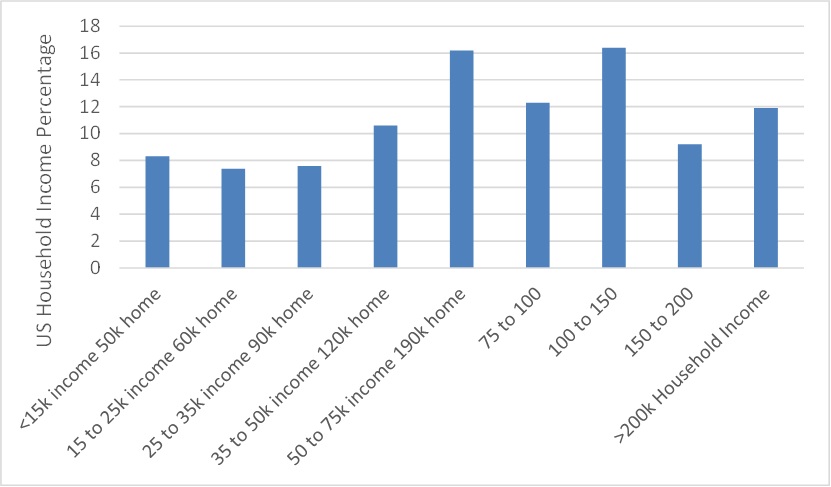

Starter homes need to be built to match income distribution.

Cost of floor area per ft2 and number of stories

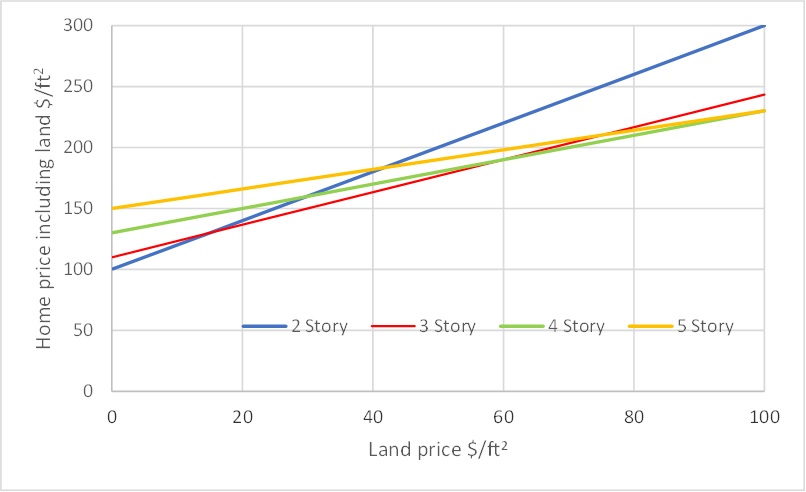

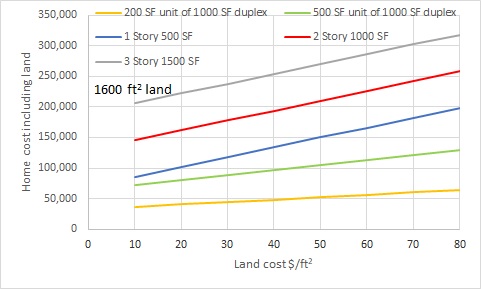

The construction cost per ft2 becomes higher when building more than 3 stories, even higher when building 5 stories, or 20 stories. Building more stories will also reduce the percentage of land cost per ft2 of floor area. Therefore, when cost per floor area ft2 is considered, there is an optimal height for a given location and construction cost vs. height. The chart shows an illustrative example assuming 25% building coverage ratio, but actual values vary for different situations.

Mortgage Affordability

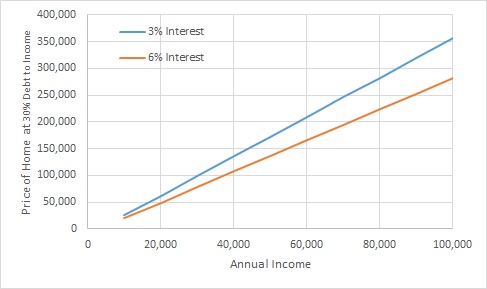

Mortgage payment increases with increasing interest rate. For 30 years mortgage, 5% interest rate means about half the total payment is for interest. 30% of gross income paying housing cost is considered affordability upper limit. 30 year is typical long term mortgage with lower monthly payments. To support a $150k mortgage, about $45k income is needed for 3% interest rate, or $55k income needed for 6% interest rate. Data is based on mortgage-calculator . Property tax is assumed Houston (Harris county) 2.13%, insurance $945/month, 0 other debt, $1 down payment, and 0 HOA.

Home cost

The chart illustrates how land cost, size of home, and building partition may impact the cost of a home.

A 1500 ft2 3 story home on a 1600 ft2 lot could cost $200k with $10/ft2 land.

A 1000 ft2 2 story home could cost $150k.

With only the ground floor 500 ft2 it could cost $90k.

Owning half of the 1000 ft2 2 story home would be $75k, either as a unit of a duplex, or as a space-assignment co-ownership with a tenants in common agreement.

If the 1000 ft2 2 story home is shared as a 200 and 800, the 200 may cost $40k while the 800 $110k.

1600 ft2 is minimum average lot size (27 dwelling units per acre) in the City of Houston.

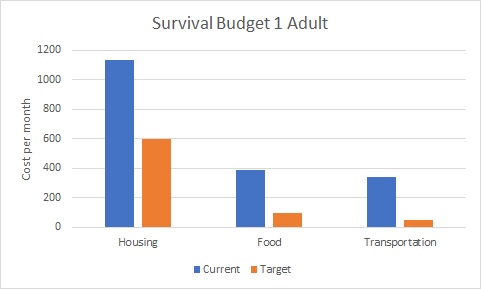

Survival budget

Current ALICE Household Survival Budget is based what people currently spend. For housing, as there is shortage of starter home, people do not have the choice to reduce housing cost. Buy building more starter homes, housing budget could be reduced. By growing vegetable and fruits in the community and preparing more food in the community, food budget could be reduced. By car and drive share, less car use in building walkable communities, and doing car maintenance and repair in the community, transportation budget could be reduced.